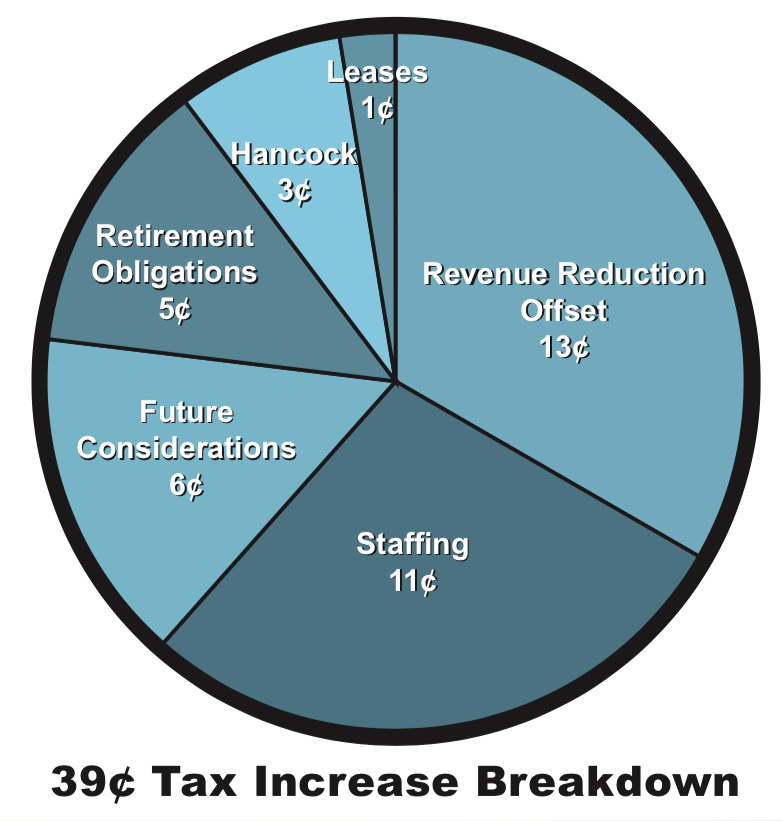

Where did the funds go from Prop E?

- Revenue Reduction Offset – $0.13 The deficit created from the loss of the Chrysler plant, property valuation tax appeals granted by the state tax commission currently at 3.8 million dollars, loss of 550,000 due to tax appeals awarded in 2017. Increase cost of inflation for apparatus, ambulances operational costs.

- Staffing – $0.11 The District has added 3 front line Firefighter/Paramedics, a Deputy Chief of Training and added part-time business inspectors.

- Future Considerations – $0.06 Capital expenditures such as purchasing future apparatus, ambulances, backup turnout gear, and equipment necessary for job performance.

- Retirement Obligations – $0.05 Funds allocated to keep the pension funding requirements solvent and on solid ground.

- Hancock Amendment – $0.03 The Hancock Amendment requires the state to refund money to income tax payers when revenues are in excess of a percentage based upon the personal income of Missourians. If, in any given year, there is a revenue surplus greater than 1% of the revenue limitation, the political entity must refund the money to taxpayers. The amendment is often known as the “tax and spending lid” whose purpose is to limit taxes by establishing tax, revenue and spending limits for the state legislature and other political subdivisions that may only be exceeded with voter approval.

- Leases – $0.01 Due to the revenue reduction offset, it was necessary to lease 2 apparatus to keep funding for future considerations such as vehicle and apparatus replacement.